If you’re in the construction business, you already know it’s a tough industry. From juggling project timelines to managing your team and clients, there’s always something that needs your attention. But one thing that often gets overlooked, until it’s too late, is cash flow. Poor cash flow management can cripple even the most successful contractor, and if you’re not careful, it can lead to serious financial trouble.

So, let’s take a closer look at some of the most common cash flow mistakes that could sink your construction business and, more importantly, how to avoid them. Whether you’re a seasoned pro or just starting out, keeping your cash flow in check is critical for long-term success.

Slow Invoicing: The Silent Cash Flow Killer

If your construction business is slow to invoice, you’re already behind the eight ball. Delayed invoices mean delayed payments, which ties up your cash flow at a time when you need it most. Let’s face it: running a construction business is expensive. From materials and equipment to paying your crew, expenses add up fast. If you wait too long to send out invoices, you’re essentially giving your clients an interest-free loan, all while your own bills pile up.

To improve your cash flow, you need to get serious about catching invoice timing mistakes. Set up a system that ensures invoices go out immediately upon completing a milestone or project. You can also offer incentives for early payments, like small discounts, to encourage faster cash inflows. Remember, the sooner you get paid, the sooner you can reinvest in your business.

Don’t Put All Your Eggs in One Basket

While landing a big client can feel like hitting the jackpot, putting all your focus on one major account can be a huge cash flow risk. As a contractor, relying too much on a single client is like building a house on shaky ground. If that client delays payment or, worse, decides to take their business elsewhere, your entire cash flow can dry up overnight.

To keep your construction business on solid financial footing, diversify your client base. Develop a mix of smaller and mid-sized clients, so you’re not overly reliant on one revenue stream. Not only does this protect your cash flow, but it also creates more opportunities for growth and stability. A well-balanced portfolio of clients means that even if one falls through, your construction business can continue to operate smoothly.

Late Payments: The Domino Effect on Your Cash Flow

Late payments are one of the most frustrating cash flow issues for any construction business. When clients delay payments, it sets off a domino effect that impacts your ability to pay suppliers and even your own team. Before you know it, you’re facing project delays, strained relationships with vendors, and a backlog of expenses.

So how do you deal with late payments? First, make sure your contracts are ironclad when it comes to payment terms. Be clear about deadlines and the consequences of late payments, such as interest charges or work stoppages. Second, don’t be afraid to follow up. It might feel uncomfortable, but regular reminders can go a long way in speeding up payments and protecting your cash flow. The longer you wait, the harder it becomes to collect.

Inconsistent Invoicing Practices = Inconsistent Cash Flow

If your invoicing process is all over the place, you’re inviting trouble. Inconsistent invoicing leads to payment delays, and before you know it, you’re stuck covering expenses and watching your profits disappear. Standardize how and when you invoice, so you always know when to expect the cash – and your bank account stays healthy.

Inconsistent invoicing is another major cash flow mistake that can wreak havoc on your finances. When your invoicing process isn’t standardized, you leave room for delays, errors, and confusion. Worse, it becomes difficult to track payments, forecast revenue, or manage project budgets.

For smoother cash flow in your construction business, create a system that’s simple and repeatable. Make sure your invoicing process is consistent. Set up regular intervals for invoicing – weekly, bi-weekly, or monthly – and stick to it. This way, you’ll always know when money is coming in, and you can plan your expenses accordingly.

Loose Credit Management: A Cash Flow Time Bomb

Letting clients get away with loose credit terms? It might be time to rethink that. While you want to be flexible, being too lenient can put unnecessary strain on your finances. Set clear credit policies and stick to them—it’ll help protect your cash flow and keep your business on track.

It’s tempting to offer lenient credit terms to secure more clients, but loose credit management can blow up your cash flow. Sure, offering flexible payment terms can attract more business, but if you’re not careful, it can also leave you chasing after unpaid invoices, draining your resources in the process.

To keep your cash flow in check, tighten up your credit policies. Do thorough background checks on new clients, and be clear about your payment terms from the start. Don’t hesitate to enforce late payment penalties, and consider requiring upfront deposits or progress payments on larger projects. This ensures you have a steady stream of cash to cover your expenses without relying on credit.

The Bottom Line: Protect Your Cash Flow, Protect Your Construction Business

In the construction business, cash flow is king. You could have the best projects, the top clients, and an all-star crew, but without strong cash flow management, your business is vulnerable. Avoid these common contractor cash flow mistakes, and you’ll put your construction business in a much stronger position to thrive.

Don’t wait for cash flow problems to sneak up on you. Take action now to tighten up your invoicing, diversify your client base, manage credit wisely, and tackle late payments head-on. By doing so, you’ll protect your construction business from financial strain and set the stage for long-term success.

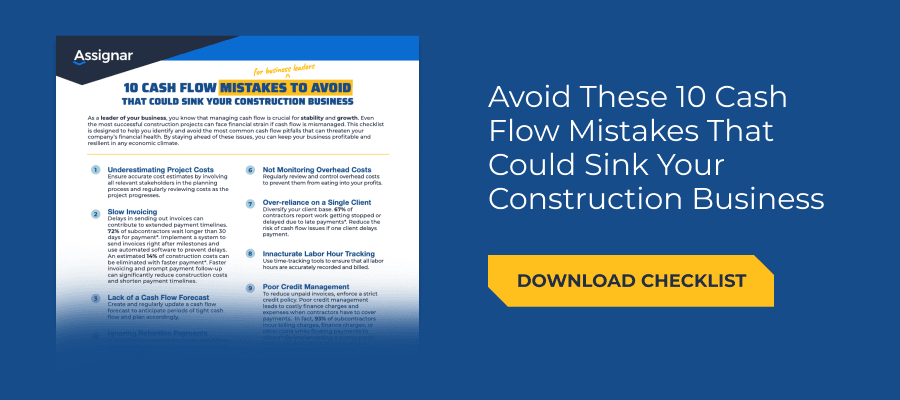

Ready to dive deeper into cash flow management for your construction business? Download Assignar’s free checklist on “10 Cash Flow Mistakes to Avoid for Business Leaders” and learn how to avoid the pitfalls that can hurt your bottom line. It’s a must-read for contractors looking to keep their cash flow steady and their businesses growing!

About Assignar

Assignar is a leading operations and workforce management platform designed for the construction industry. Its cloud-based solution helps contractors improve productivity, compliance, and safety by streamlining scheduling, resource management, and data collection. Assignar enables contractors to manage field operations more effectively, gain actionable insights, and deliver projects on time. Learn more at assignar.com.