When you started in construction, did you think you’d spend this much time worrying about time?

Tracking. Collecting. Managing. Reporting. Auditing.

Time tracking in any business is no joke, but doing it in construction in California is doubly difficult. California has the country’s strictest wage and hour laws—and the penalties to match.

“The California market is interesting. There’s a lot more scrutiny on how our hours are captured and how workers get paid than in other states.” —Matt Lucas, Director of Product Management at Assignar.

When you’re operating on the tight margins standard in today’s construction projects, you can’t afford to get it wrong.

Here’s a window into California labor laws and a quick look at steps you can take as a construction industry leader to stay compliant.

Keeping up with California time-tracking compliance

California has some of the strictest wage and hour laws in the country in an effort to protect workers from exploitation. For emerging construction companies, it’s easy to violate these regulations accidentally and face hefty fines or company-closing penalties.

Matt Lucas, Director of Product Management at Assignar, has seen construction organizations fall into this trap because they were unprepared.

“The last thing they need is an additional cost incurred for penalty and wage issues,” Lucas said.

Don’t be caught off guard—be aware of these labor regulations.

One quick note: For the purpose of this article, we’re talking about non-exempt employees. Typically, they’re hourly employees paid under $64,480. An exempt employee is one that doesn’t qualify for overtime. They’re paid a salary and usually work an office job, like administrative and executive positions.

“The last thing they need is an additional cost incurred for penalty and wage issues,” Matt Lucas.

Overtime costs

Rules and regulations around overtime are highly detailed for California businesses—and in the construction industry, overtime is part of the job. You need to know the rules so you don’t accidentally incur costs.

“Overtime’s a reality in construction,” Lucas said. “[Construction businesses] don’t want to blow their budgets on double time and overtime.”

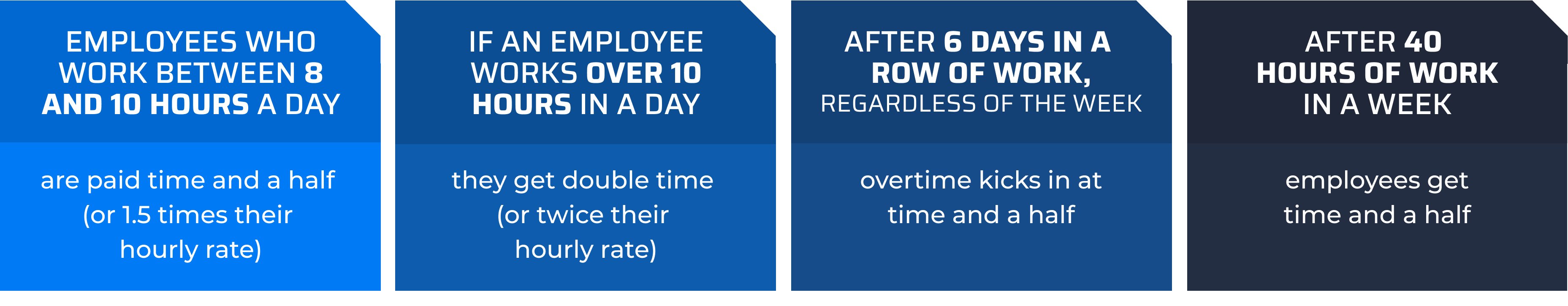

Here are some of the overtime regulations you should know:

Regular 10-hour work days are allowed as long as employees get paid for overtime after 40 hours. Employees get time-and-a-half pay after 10 hours and double time after 12.

Overtime is a common occurrence across industries, and construction is no different. So, what’s the best way to control overtime costs?

Visibility.

Create weekly reports to see who collects the most overtime, and dive into what you can do to fix it. Does your excavation team always go over? Which crew or discipline is the biggest offender?

Use your field data to dig into the issue.

Timekeeping takeaway: Budget for overtime and create reports to identify repeat offenders.

Meal breaks and rest periods

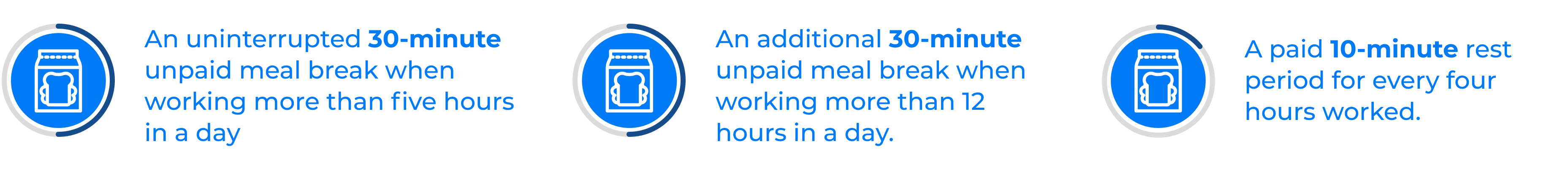

Most California non-exempt workers must receive the following breaks:

There are also several stipulations as to when employees take these breaks. For example, rest periods should take place as close to the middle of the four-hour period as reasonably possible. Employees may waive rest breaks as long as you’ve offered them at appropriate times.

The penalty? If you don’t offer an employee a 10-minute break (and accommodate that break), you owe them an additional hour of pay. The same goes for their uninterrupted meal break. And if they miss both? That’s two hours.

Marcel Broekmaat, Assignar’s Chief Product Officer, says construction companies handle break times in different ways to ensure compliance. For example, some supervisors will call break times for the entire job site and enter the break times into the timesheets themselves.

“[One California client] only wants the workers to check into the job and check out of the job,” he said. “During the day, they won’t don’t want their workers on their phones because it’s a safety hazard.”

So instead of managing multiple breaks and meals (and potentially letting a few employees slip through the cracks), the foreman calls a break time for everyone and adds it to their timesheets. It’s one business’s solution to avoiding additional costs while also ensuring every employee gets sufficient breaks.

Timekeeping takeaway: Track and enforce break times—or you’ll end up paying for an extra hour.

Record keeping

Employers are responsible for detailed timekeeping records for all non-exempt employees under California law, including:

- Work start time and end

- Meal period start and end times

- Rest periods (not required, but recommended)

- Split shift start and end times

- Overtime hours

- Total daily hours

- Total weekly hours

While the onus may be on employees to fill out their timesheets, the employer is legally responsible for keeping that information. Plus, employees have a legal right to request detailed records of their hours at any given time.

What does “detailed” mean? Say Bob worked an eight-hour day on December 14. You’ll need to provide the time Bob started working, when he took his lunch break, and if and when he took his 10-minute rest periods. Employers must keep these records for a minimum of three years.

Do you need employee signatures on every timesheet? Legally, no, but it’s highly recommended you get some form of employee acknowledgment, whether that’s a physical signature or a digital acceptance.

Timekeeping takeaway: Keep detailed records of employee timesheets for at least three years in case a dispute should arise. Time-tracking software simplifies the process of maintaining and storing these records.

The cost of time-tracking errors

Paying a fair wage and giving your employees adequate rest time is critical in all fields—but it’s especially important in the construction industry. With the labor shortage, you want to treat your employees well, keeping their safety in mind.

Conversely, the cost of being non-compliant can spell disaster for your business.

Penalties

Depending on the infringement, you could pay penalties for each violation. On first offenses, employers have to pay $50 for each underpaid employee for each pay period they were underpaid. On any violations after, the penalty increases to $100 per employee.

The business may also receive fines from the labor commissioner for overtime wage violations (California Labor Code Section 1197.1).

Audits

If you’re still keeping paper records, getting audited could be a mess. Since you have to maintain three years of detailed time-tracking records for each employee, you better have a good filing system. Otherwise, you’re spending weeks digging through boxes in your storage unit.

Back pay

This is where construction companies can really get into trouble, Lucas explains.

“If you’re an offender, and you offended for six months, and you didn’t know it, or you just let it go and swept it under the rug—that could really cost you,” Lucas said.

For example, if you weren’t aware of the paid 10-minute rest periods and had an entire crew working for months, the back pay would add up. You’d have to pay an extra hour for every violation. For a week of eight-hour days, that would be an additional 10 hours of pay—per employee.

Timekeeping is only the beginning

Meeting compliance in construction in California takes an in-depth knowledge of the regulations and expert organization and management. From time tracking to certifications to mandatory trainings, it’s a lot to pay attention to—especially if you’re still doing it on paper.

This is just a small piece of the compliance landscape in California and the wider United States. Keep an eye out for our upcoming eBook to go deeper into compliance in the construction industry and explore more ways to avoid violations.

In the meantime, see how Assignar can help you maintain compliance and track all your organization’s moving parts.