Accounting Cash Flow Checklist

Top 10 Cash Flow Mistakes for Accounting to Avoid

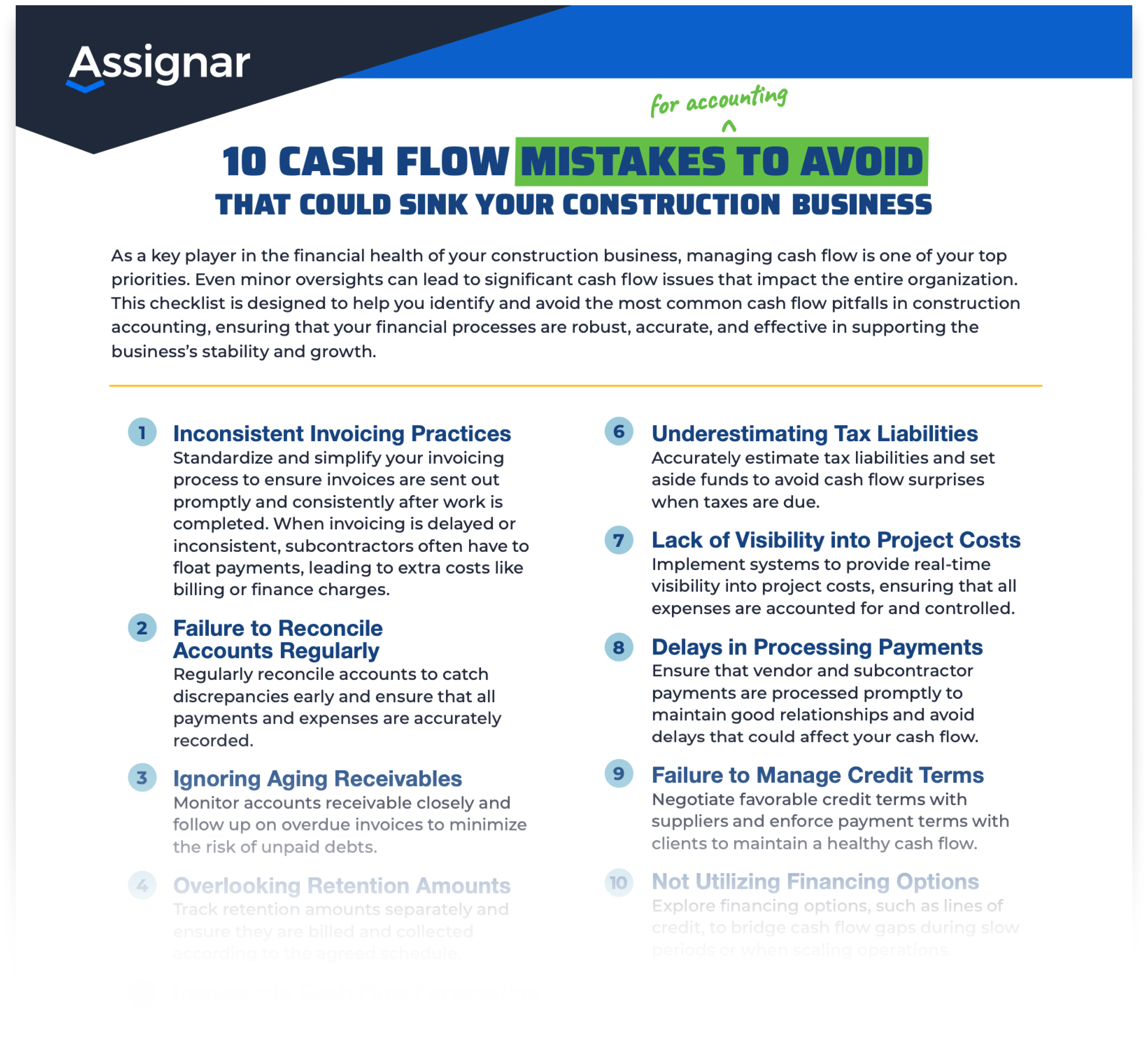

Cash flow problems are one of the biggest challenges to maintaining efficient accounting processes in construction. In our checklist for Accounting, "10 Cash Flow Mistakes That Could Sink Your Construction Business," check the most common financial pitfalls that can disrupt your cash flow and overall financial health, along with practical solutions to overcome them. Don’t let these mistakes threaten your company’s financial stability.

Download the checklist now to ensure smooth cash flow management and safeguard your business’s future.

Here’s a sneak peek at what you’ll find:

- Inconsistent Invoicing Practices: Delayed or inconsistent invoicing can lead to subcontractors floating payments and incurring finance charges. Standardize your invoicing process to ensure prompt and consistent payments.

- Failure to Reconcile Accounts Regularly: Infrequent account reconciliation can cause discrepancies and missed expenses. Regularly review your accounts to catch errors early and ensure financial accuracy.

- Ignoring Aging Receivables: Failing to follow up on overdue invoices can lead to unpaid debts. Stay on top of aging receivables to maintain a steady cash flow.

- Inadequate Cash Flow Forecasting: Without proper forecasting, you risk running into periods of tight cash flow. Develop and update a detailed cash flow forecast to anticipate and manage these fluctuations.

- Underestimating Tax Liabilities: Failing to set aside funds for taxes can lead to cash flow surprises. Accurately estimate tax liabilities to avoid shortfalls when payments are due. Download the full checklist to explore all 10 cash flow mistakes and actionable strategies for maintaining financial stability in your construction accounting processes!

How Assignar Keeps Projects Moving

Flexible Crew Scheduling

Simplify scheduling and streamline communication between your crew, contractors, and subcontractors, using a bird’s-eye view to plan projects.

Ditch Paper Timesheets

Painlessly collect critical data through the Assignar App. Now, you don’t have to guess what’s happening in the field.

Keep Equipment Running

Match the right workers and the right equipment to the right jobs at the right time. Get the most out of your resources.